COOPERATION MODEL

ARTIFICIAL INTELLIGENCE

PRODUCT ENGINEERING

DevOps & Cloud

LOW-CODE/NO-CODE DEVELOPMENT

INDUSTRY

FRONTEND DEVELOPMENT

CLOUD DEVELOPMENT

MOBILE APP DEVELOPMENT

LOW CODE/ NO CODE DEVELOPMENT

EMERGING TECHNOLOGIES

Financial advisors spend about 40% of their week on tasks that don’t need their expertise, like taking meeting notes, entering data, and tracking down forms. The other 60% is where their skills really count.

This split between meaningful work and busywork has always existed. AI is now helping companies close this gap. In this article, we look at how AI is changing wealth management, what’s really different, and what’s staying the same.

Wealth management has an image problem, but it’s not what most people expect. Many see advisors as market experts who move millions with a single call. In reality, most advisors spend much of their time on administrative work that doesn’t use their financial skills. They have to find clients, handle paperwork, and only occasionally get to focus on financial strategy when time allows.

In the past, client prospecting meant reaching out to hundreds of people and hoping a few would reply. Now, AI software can quickly analyze public data to find people who are more likely to have real financial potential.

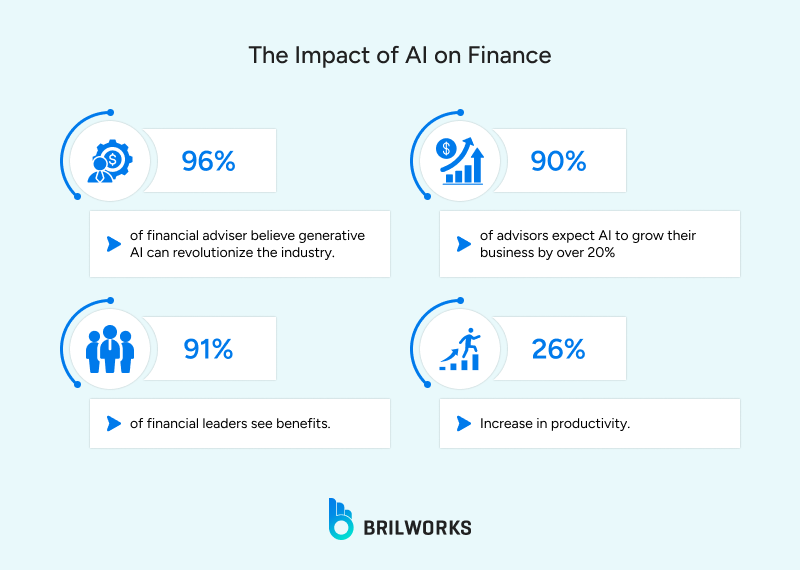

AI prospecting tools are cutting manual prospecting time by 40% to 50%. And the sentiment reflects that 90% of advisors believe AI can help them grow their client base.

Another way AI helps in wealth management is by speeding up meeting preparation, which used to take hours. Advisors once had to review files, emails, and market reports before making an agenda. Now, AI tools gather this information automatically and create agendas based on previous discussions and recent changes, all in minutes.

Client onboarding is still a challenge, but it’s getting easier. Know Your Customer rules require checking identity, income sources, and other details. AI can now read documents, pull out information, and spot inconsistencies. Automation can speed up onboarding by 50%, so firms could potentially double their yearly client growth.

See Also: Top Innovative Generative AI Applications in Action

Most wealth management firms still use software that was built before smartphones. Many of these core systems started in the 1990s. Replacing them would cost an arm and a leg, so new AI companies are building tools that work with these old systems instead of replacing them.

Specialized tools for specific problems. Instead of one massive platform, firms now use focused tools:

one for meeting notes,

one for estate planning,

one for compliance checks.

Each solves an expensive problem. Each saves enough time to justify its cost.

As advisors use these new AI tools more, they use the old systems less. The AI tool becomes where advisors actually work. The old system becomes just a database in the background. Eventually, the AI tool becomes central and the old system fades away.

This matters for anyone building software in this space, you don't need to build everything. You need to solve one expensive problem really well.

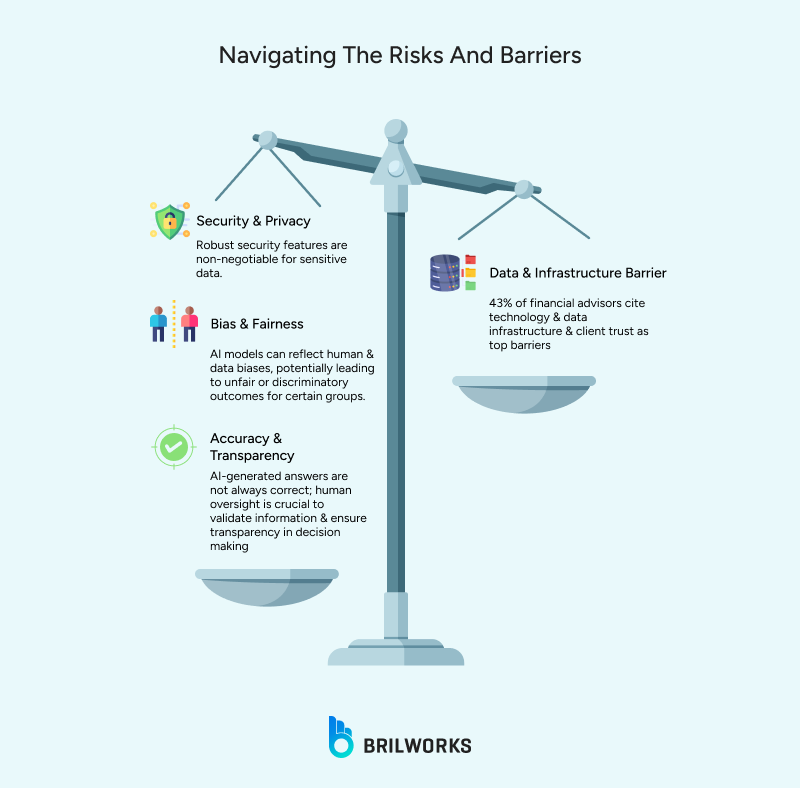

The biggest obstacle to AI adoption isn't technical; it's trust. When surveyed, 43% of financial advisors cited technology, data issues, and client trust as their top barriers to adopting AI. It's based on real risks.

The accuracy problem is a real issue. AI can make mistakes with confidence, like creating a detailed financial plan with incorrect tax calculations, all perfectly formatted with no sign that anything is wrong. As Michael Lewis, Chief Information Officer, BNY Pershing, put it: "We often assume that when AI generates an answer, it must be right. And that's not true at all." AI is built and trained by humans using human-provided data, which means it inherits the same biases and errors that humans have.

The data quality is crucial. If you give AI messy data, you’ll get messy results. Many firms have client information spread across different systems, with some data outdated or even conflicting.

Plus, the infrastructure problem is significant: outdated systems, siloed data, and poor-quality data create barriers to effective AI implementation. Some firms have blocked certain generative AI models entirely because they're trained on internet data that isn't carefully vetted.

Bias isn't theoretical. AI trained on historical lending data can inherit historical discrimination patterns. If your training data includes decades of biased lending decisions, your AI will recommend similarly biased strategies. Testing for this requires constant work.

People still need to check AI’s work. The best firms use AI like a junior analyst—it creates the first draft, but humans review, question, and approve the results. This helps catch mistakes before they reach clients.

Here are the specific, provided use cases of AI and Agentic AI (AI that acts or automates processes) in wealth management:

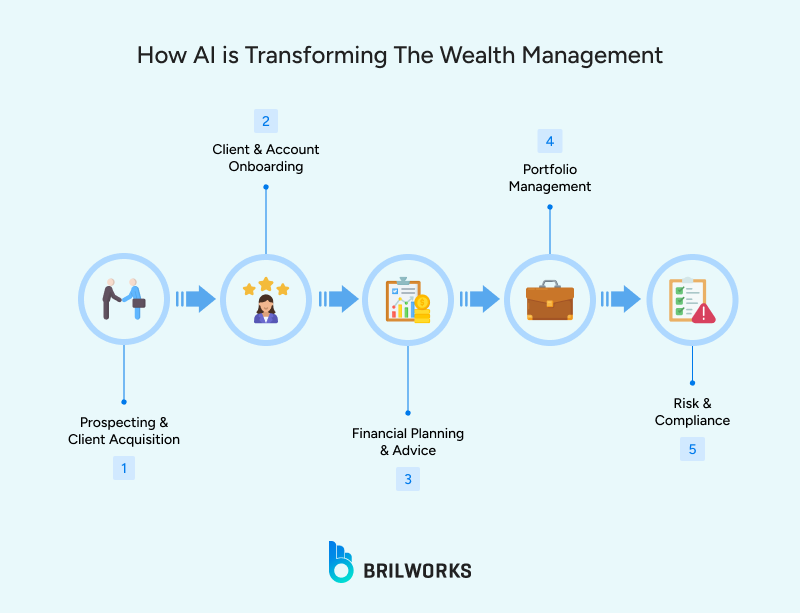

AI is used to find leads, prioritize them, and automate early engagement, enabling advisors to convert prospects faster.

AI customizes outreach messages to potential clients.

AI tools assist with the pre-, during, and post-client meeting work. Specifically, AI can analyze advisor profiles and historical meeting notes to generate personalized meeting agendas. It also helps advisors take notes during calls, uploads information to the CRM, and plans next steps.

AI agents streamline the client onboarding process, including essential regulatory tasks like Know Your Customer (KYC) and Anti-Money Laundering (AML) obligations. Automation can accelerate client onboarding by 50 percent.

AI-driven chatbots or virtual advisors handle routine client inquiries instantly. They can reply instantly in the customer’s language, overcoming language barriers.

Virtual advisors guide users through budgeting or investment strategies with personalized assistance.

Generative AI personalizes product suggestions to enhance client engagement.

AI agents generate timely, personalized reports and proactively communicate with clients to prevent issues.

AI personalizes financial planning by analyzing a client’s income, expenses, and investment goals to give tailored recommendations.

Generative AI automates customized financial plans, saving time for advisors.

AI offers real-time insights and predictive analytics to help clients make informed decisions based on market trends and risk assessments.

AI solutions are applied to complex, document-intensive tasks like Estate Planning, drastically cutting down the amount of work required for the advisor.

AI agents automate portfolio design, rebalancing, and tax optimization. They analyze vast amounts of data in real-time to spot trends, predict market trends, and make data-driven portfolio recommendations.

AI continuously monitors portfolios and suggests adjustments periodically or instantly based on changing economic conditions, client risk profiles, and financial objectives. Automated portfolio rebalancing is a highly valued use case.

AI helps advisors analyze trends and forecast market outcomes with more precision, enabling better-informed decisions for clients.

AI uses real-time data to make the best possible decisions when it comes to asset allocation.

AI is used for content summarization, content generation, code generation, and knowledge management.

AI leverages Natural Language Processing (NLP) to scan and analyze client statements or financial documents and integrate that data into portfolio management systems, speeding up processes and reducing the risk of human error.

Agentic AI accelerates processing, reduces manual intervention, and improves operational accuracy across the front, middle, and back office, including tasks like error remediation and fee billing.

AI automates surveillance, policy updates, and anomaly detection, helping firms stay ahead of regulatory changes. Automating compliance monitoring and documentation tasks can achieve cost savings.

AI helps firms identify risky borrowers and applications, detect fraud, and manage cybersecurity threats. It analyzes large datasets in real time to spot patterns and anomalies indicating fraudulent activity.

AI-based phishing simulations are employed to train employees to recognize and respond to sophisticated cyberattacks.

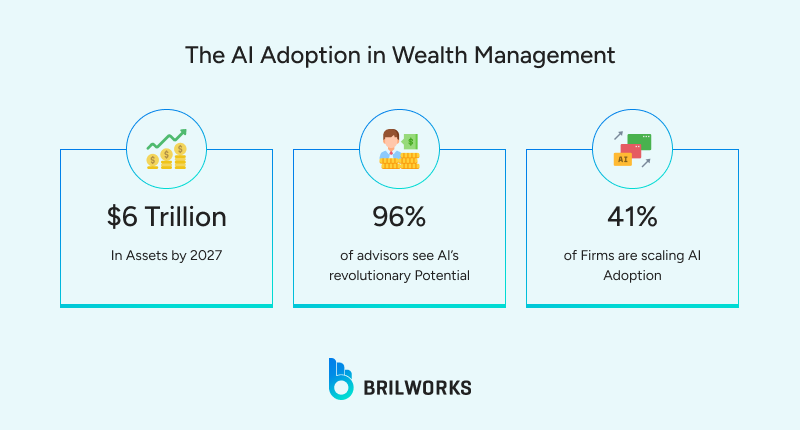

For years, detailed financial planning was reserved for wealthy clients because it took too much time to offer to everyone. AI changes the economics. When software can analyze someone's spending patterns, generate tax projections, and model retirement scenarios in minutes instead of hours, suddenly the middle market becomes profitable to serve.

Chatbots handle basic questions 24/7. "What's my account balance?" "When is my next payment due?" "Should I rebalance my portfolio?" The simple stuff gets answered instantly in any language. Advisors handle the complex conversations.

Portfolio analysis now happens all the time, not just every few months. Traditional wealth managers used to review portfolios quarterly, but AI monitors markets nonstop and alerts advisors when something needs attention. Humans still make the final decisions, so they don’t miss opportunities just because they’re busy. While AI makes things more efficient, it can feel less personal.

AI in wealth management isn’t a single big change. It’s made up of many small improvements that let advisors spend more time giving advice and less time on paperwork.

The firms winning right now are doing three things:

They're choosing specific problems to solve, not trying to automate everything at once. Meeting prep first. Then, client onboarding. Then compliance reporting. One at a time, with real measurement of what's working.

They're keeping humans in the loop, especially for anything involving judgment or client relationships. AI handles data. Humans make decisions.

They are open about AI’s limitations. They let clients know when AI is used and regularly check for mistakes. They understand that one big error can ruin years of trust.

The transformation is still in progress and far from finished. But the trend is clear: advisors are gradually returning to their main role, focusing on giving advice instead of just handling paperwork.

Whether this shift is revolutionary or simply overdue depends on your perspective.

Get In Touch

Contact us for your software development requirements

Get In Touch

Contact us for your software development requirements