COOPERATION MODEL

ARTIFICIAL INTELLIGENCE

PRODUCT ENGINEERING

DevOps & Cloud

LOW-CODE/NO-CODE DEVELOPMENT

INDUSTRY

FRONTEND DEVELOPMENT

CLOUD DEVELOPMENT

MOBILE APP DEVELOPMENT

LOW CODE/ NO CODE DEVELOPMENT

EMERGING TECHNOLOGIES

At its core, Software-as-a-Service (SaaS) is a way of delivering software over the internet, much like streaming a movie on Netflix. Instead of buying and installing a program on your computer, you access it through a web browser or an app, typically for a subscription fee. This model has completely transformed how we use software.

The scale of this transformation is immense. Today, SaaS is the dominant software model, representing more than half of the entire software market. [Source] This explosive growth has created a fast-moving business world. To understand where this multi-billion dollar industry is headed, we will explore three important SaaS trends shaping its future.

Navigating complex integrations or scaling challenges? Our saas development services ensure your product stays robust, secure, and competitive in a rapidly changing market.

The growth of the SaaS market has been nothing short of dramatic. What was once a niche model is now the default for software delivery. Here are a few figures that show its rapid growth:

1. Global end-user spending on SaaS was projected at $247.2 billion in 2024. [Gartner]

2. Worldwide SaaS spending is forecast to grow to 375.57 billion in 2026. [Fortune Business Insights]

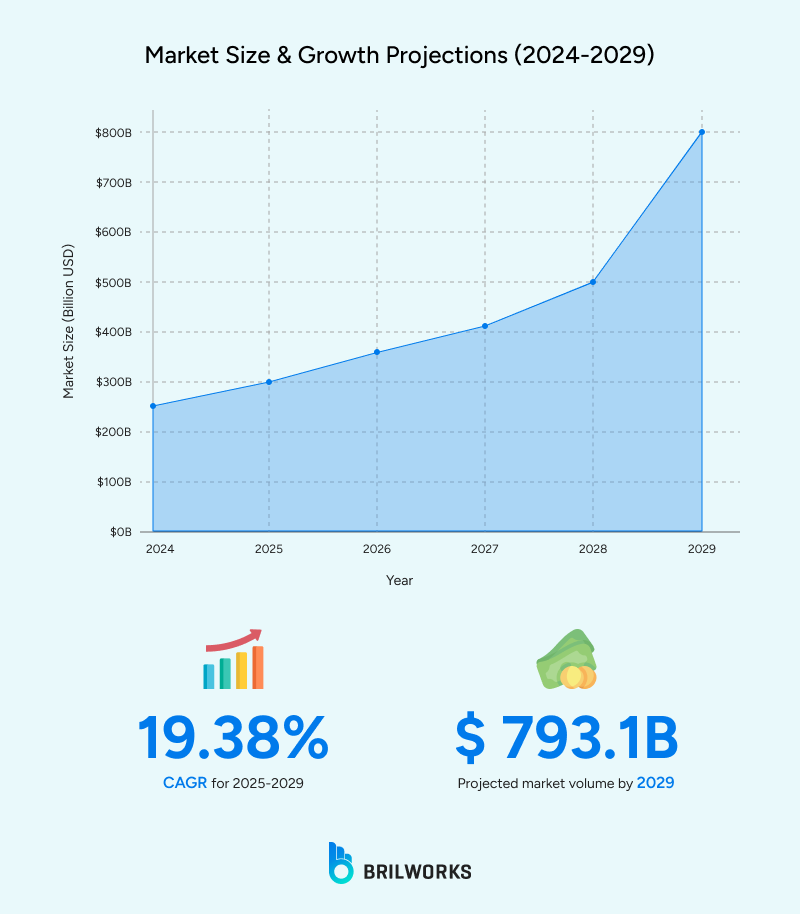

3. Worldwide SaaS revenue is expected to grow at an annual rate of 19.38% between 2025–2029, leading to a market volume of $793.10 billion by 2029. [Statista]

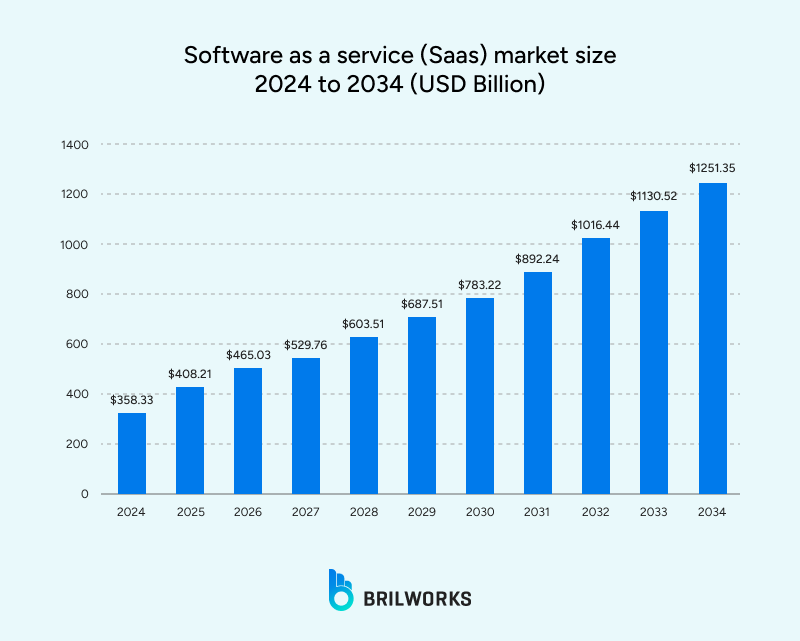

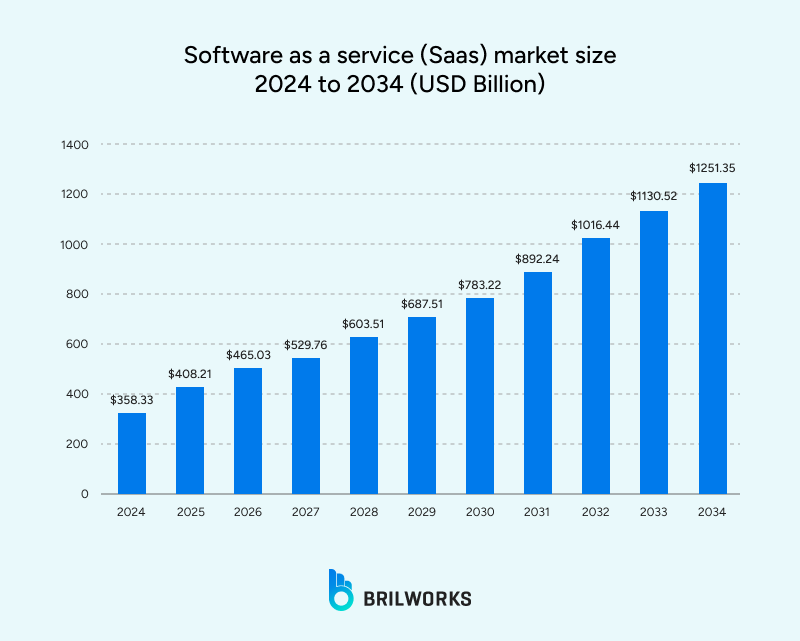

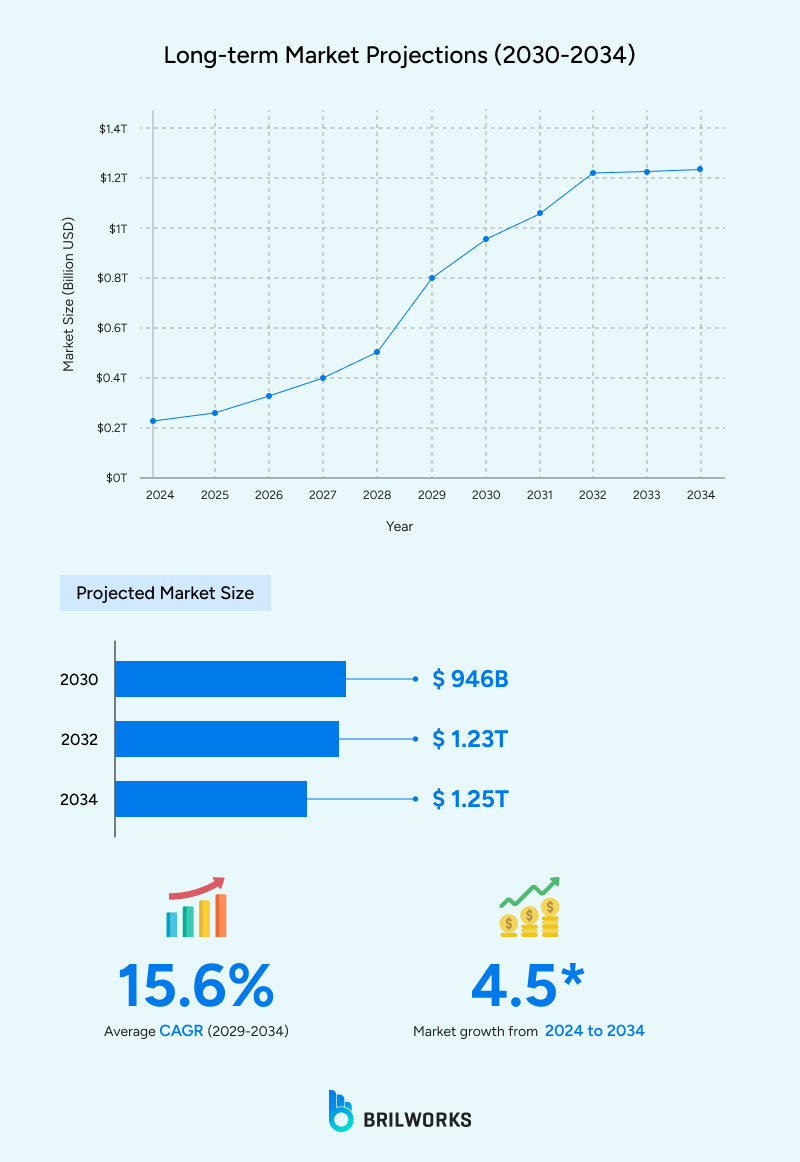

4. The global SaaS market is forecast to reach $1.25 trillion by 2034.

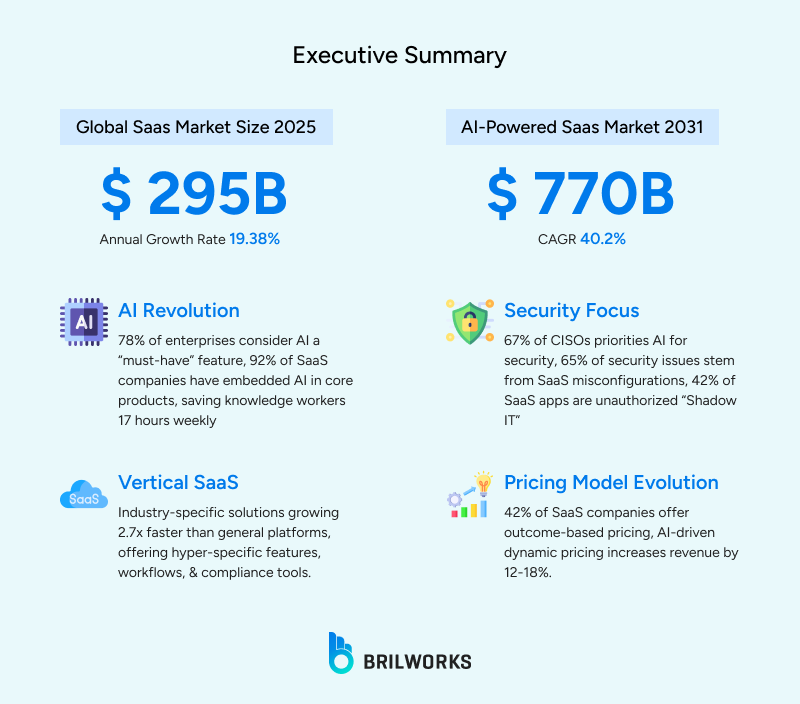

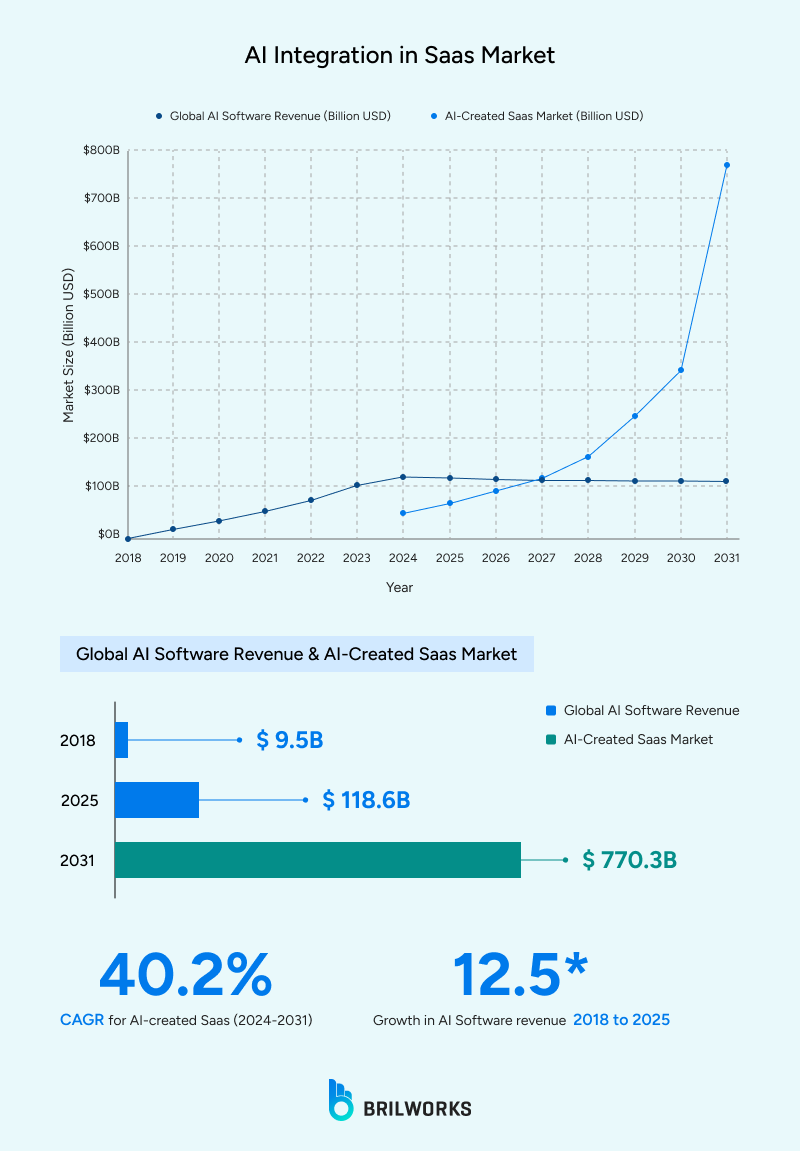

Global AI software revenue has gone from $9.5 billion in 2018 to $118.6 billion in 2025. The global AI-created SaaS market (SaaS products powered by AI) is estimated to reach $770.32 billion by 2031, growing at a Compound Annual Growth Rate (CAGR) of 40.2% from 2024 to 2031.

Worldwide end-user spending on public cloud services is expected to reach $723.4 billion in 2025. SaaS remains the largest segment of cloud spending, making up around 41% of total public cloud investment this year.

The overall number of SaaS companies worldwide remains substantial, with varying estimates. The United States continues to lead the market in terms of company count and influence.

Global Company Count: Estimates for the worldwide number of SaaS companies vary, ranging from over 30,800 to over 42,000, and possibly over 72,000. The SaaS sector currently has approximately 58,000 companies, of which 16,000 are startups.

United States Leadership: The U.S. continues to dominate, hosting the highest number of SaaS companies globally, with recent estimates placing the number at approximately 17,000, or 16,500.

Global Reach: U.S.-based SaaS providers reach an estimated 14 billion users worldwide.

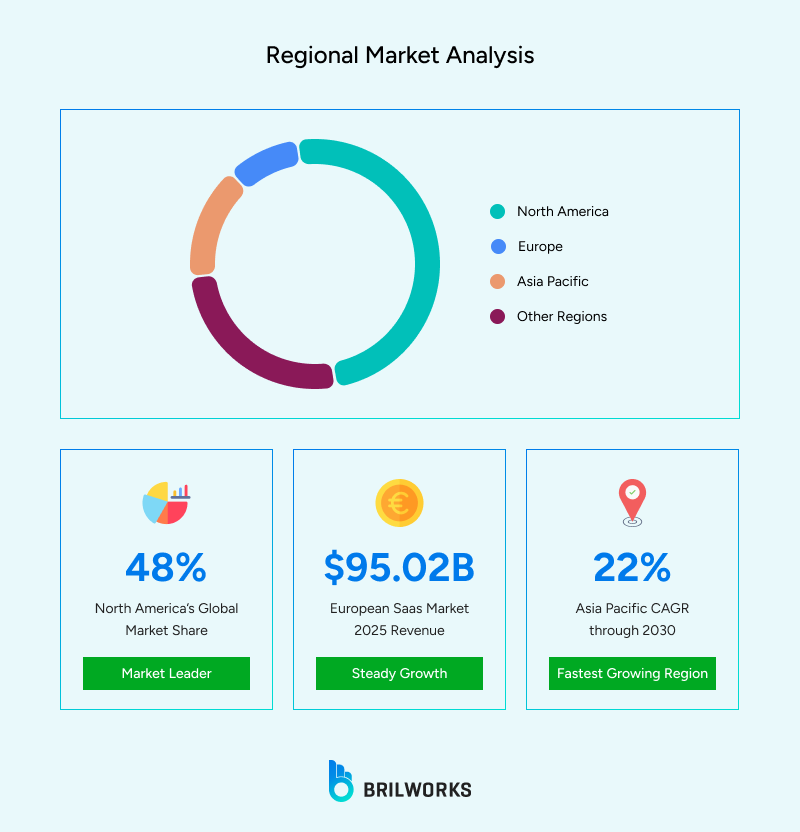

Other Regions (2025 Projections): The European SaaS Market is projected to bring in $95.02 billion in revenue in 2025. The Asia Pacific SaaS market is anticipated to grow at a CAGR of 16.1%, and is expected to be the fastest-growing region through 2030, with a CAGR of 22%.

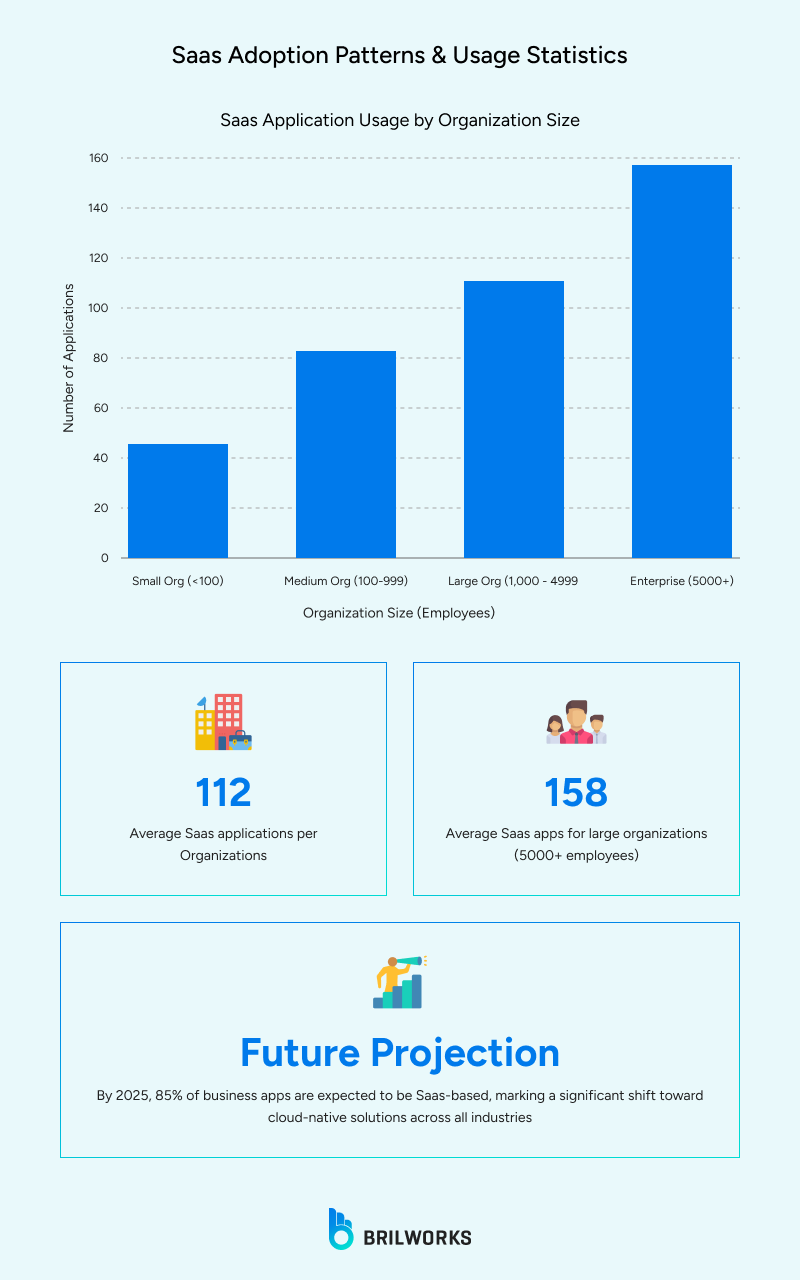

Organizations now use an average of 112 SaaS applications. Over and above that, some large organizations (5,000+ employees) use an average of 158 SaaS applications. In 2025, 85% of business applications are expected to be SaaS-based.

95% of organizations are expected to adopt AI-powered SaaS applications by 2025.

Currently, organizations use an average of 7.3 SaaS apps with AI functionality.

By 2026, more than 80% of companies are expected to have deployed AI-enabled apps in their IT environments, up from just 5% in 2023.

59% of IT teams remain concerned about Shadow IT in 2025.

ChatGPT has claimed the #1 spot in the shadow IT chart, and 20% of all breaches were reported to be due to “Shadow AI”.

By 2027, 75% of employees are expected to acquire, modify, or create technology without IT’s oversight.

Pricing Impact: The financial commitment is high, with organizations spending up to $3,500 per employee on SaaS annually. However, AI-driven dynamic pricing is emerging, which increases revenue by 12–18%. Furthermore, 42% of SaaS companies now offer outcome-based pricing, where payment is tied directly to delivered results.

The SaaS industry is currently being reshaped by several interconnected trends that are fundamentally altering product development, go-to-market strategies, and user expectations.

AI's influence is reshaping what users expect from software and how businesses operate. Two outcomes are especially clear:

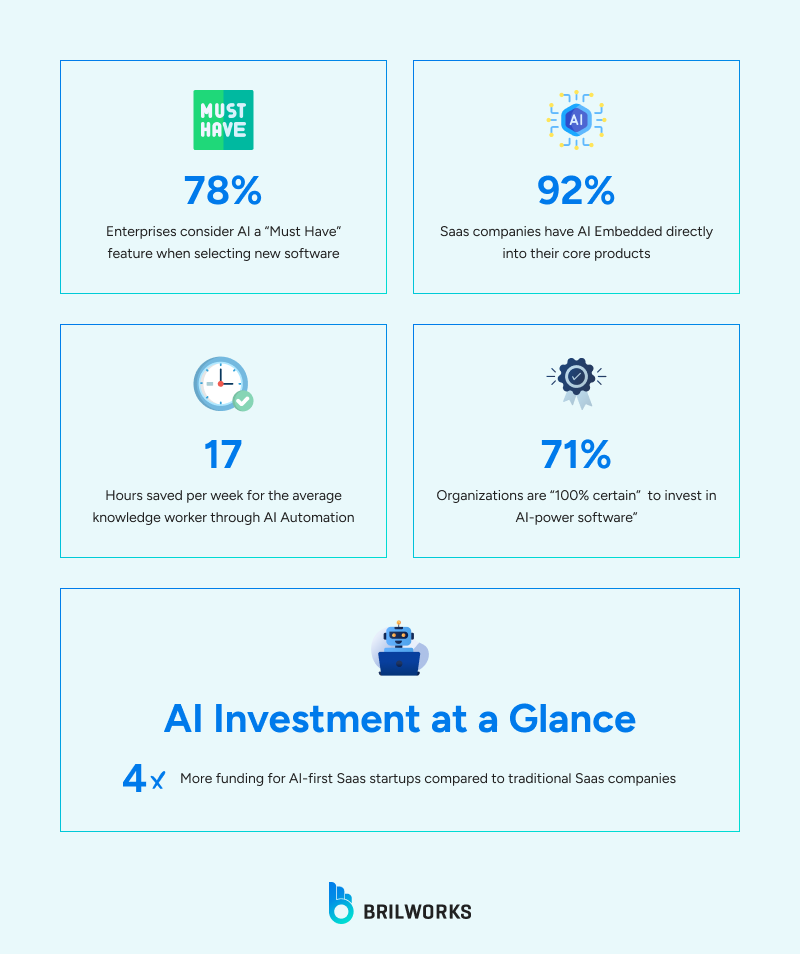

AI is now a "must-Have"feature: According to recent surveys, 78% of enterprises state that AI capabilities are a "must-have" feature when selecting new software. In response, an overwhelming 92% of SaaS companies now have AI embedded directly into their core products.

AI is improving business automation and efficiency: It's estimated that AI automation saves the average knowledge worker 17 hours per week.

The financial momentum behind this trend is also compelling, with investment and business commitment signaling a big shift.

|

Funding |

AI-first SaaS startups receive 4x more funding than traditional SaaS companies. |

|

Business Commitment |

71% of organizations are "100% certain" or "extremely likely" to invest in AI-powered software. |

As companies delegate more of their critical operations, data to SaaS platforms, protecting the data and information is now a paramount concern for them. This has started a cybersecurity "arms race," where SaaS providers and their customers must constantly adapt to defend against evolving threats.

Shadow IT: The practice of using software and services by employees without official approval or oversight from the IT department is referred to as shadow IT. This creates security blind spots, with some estimates suggesting that 42% of SaaS apps are unauthorized "shadow IT." The problem is so pervasive that now it alone accounts for 22% of all security incidents.

Misconfigurations: In 2025, SaaS misconfigurations are responsible for as many as 65% of organizational security problems.

In response to these growing challenges, the industry is turning to advanced technology for defense. Today, 67% of Chief Information Security Officers (CISOs) say that Artificial Intelligence is their top security investment.

While vigorous security is a universal need, the market is maturing beyond broad protections. Businesses now demand precision-engineered security solutions.

Another major shift in the SaaS niche is Vertical Saas. The demand for specialized (or custom) tools is growing year over year. Vertical SaaS refers to software created for the unique needs of a specific industry. This is in contrast to Horizontal SaaS, which offers general-purpose solutions for a range of industries.

The big benefit of Vertical SaaS is that it provides hyper-specific features, workflows, and compliance tools, ideally tailored to a particular industry's operations. This eliminates the need for expensive customizations.

Recent analysis shows that niche, industry-specific solutions grew over 2x faster than general-purpose platforms. This trend signals a maturation of the SaaS market, where deep industry expertise and tailored solutions are becoming more valuable than one-size-fits-all tools.

Traditional, fixed-subscription pricing models are being replaced by usage-based, hybrid, and outcome-based ("pay-for-performance") pricing. These models allow customers to pay for the value they actually receive. This development reveals a more mature market where customers demand greater transparency and a clearer return on their software investment.

The global SaaS market in 2026 is defined by the convergence of unprecedented market scale and technological shifts. As the industry surpasses previous growth benchmarks, it is also undergoing a profound development driven by Artificial Intelligence (AI). This analysis will provide a comprehensive overview of the market's quantitative dimensions, exploring its size, growth projections, and key drivers.

These projections underscore the immense scale and sustained momentum of the SaaS industry. The global SaaS market is valued in the hundreds of billions of dollars, with strong year-over-year growth anticipated for 2025. The following table compares market size projections from prominent sources:

|

Source |

2025 Market Size (USD) |

2026 Projected Size (USD) |

|

Gartner |

$315.68 billion |

$375.57 billion |

Long-term growth predictions support a positive view, with many sources expecting strong SaaS industry growth for many years.

The market is projected to reach a volume of $793.10 billion by 2029, with an expected Compound Annual Growth Rate (CAGR) of 19.38% between 2025 and 2029.

The SaaS market is still centered in a few main regions.

North America continues to be the dominant force, holding approximately 48% of the global market share.

The United States hosts the largest number of SaaS companies by a significant margin. The table below compares the top five countries by company count from different sources.

While North America leads, the Asia-Pacific region is identified as the fastest-growing market, with a projected CAGR of 22%

Venture capital investments often show where the market is headed. Right now, funding for SaaS companies shows that the market is maturing. Recent data suggests that even though investment levels have slowed compared to their highest points, the market is still active and more focused on strategic growth.

In 2023, US-based SaaS and enterprise software startups received $17.4 billion in VC investments (Crunchbase).

In the first half of 2024, worldwide VC investment in SaaS startups reached $72.3 billion (Dealroom).

Early-stage VC deal investment (rounds under 15 million) for H1 2024 totaled 10.3 billion (Dealroom).

The main focus of today’s investment isn’t how much money is being invested overall, but where it’s going. Instead of spreading funds across the entire sector, investors are now targeting two main areas: AI-focused startups and large, established companies.

AI-first SaaS startups are getting more funding than traditional ones. It shows that investors see AI as the key driver of future growth and value in the software industry.

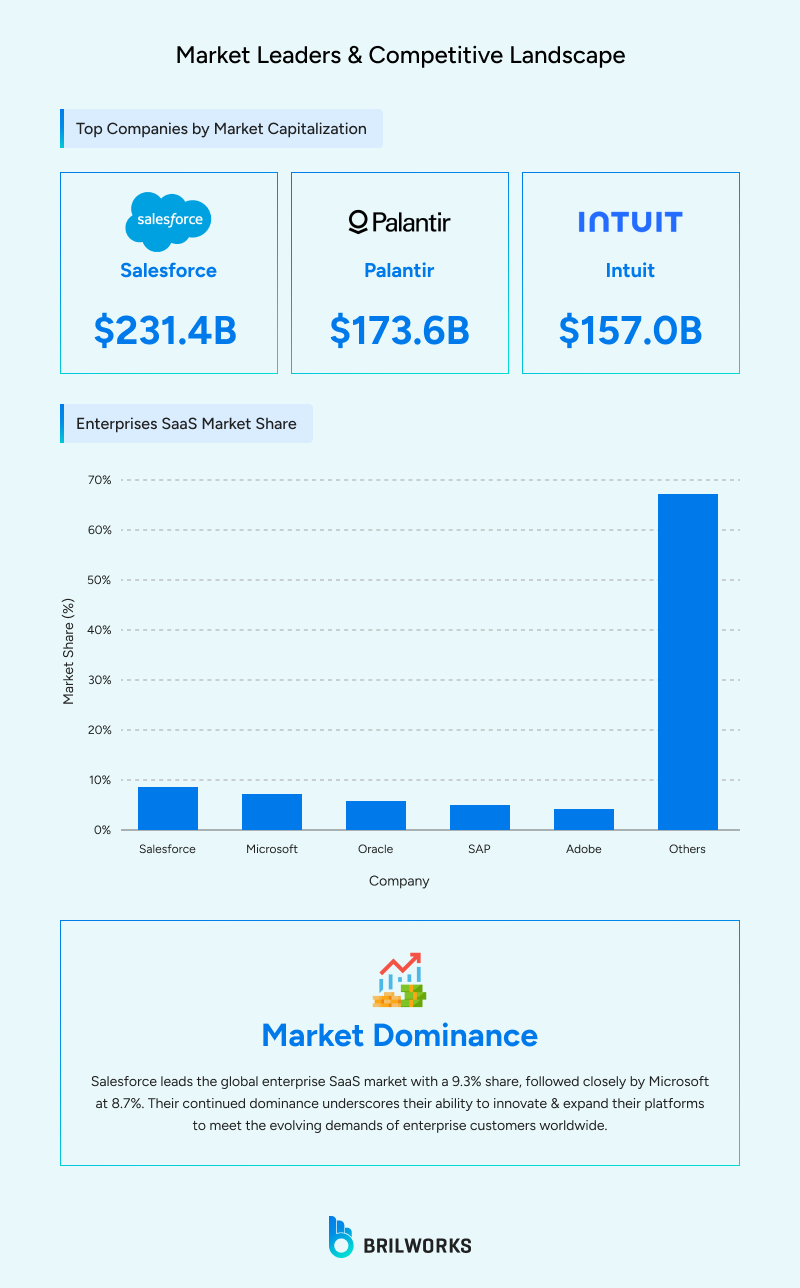

Although general lists of the biggest companies often include large tech conglomerates, looking specifically at SaaS-focused companies shows leaders like Salesforce and Intuit, which are central to the enterprise software market.

In terms of market share among enterprise SaaS vendors, two companies lead the way. According to 2025 data from Synergy Research, Salesforce leads the global market with a 9.3% share, followed closely by Microsoft at 8.7%.

The SaaS industry is growing fast, and investors are paying close attention to companies using AI. The market is accelerating, giving businesses the tools to take control of their SaaS ecosystem and drive real innovation. As a SaaS development company, we provide expert-backed consulting to help you cut licensing waste, tackle shadow IT, and scale your operations.

Get In Touch

Contact us for your software development requirements

Get In Touch

Contact us for your software development requirements