COOPERATION MODEL

ARTIFICIAL INTELLIGENCE

PRODUCT ENGINEERING

DevOps & Cloud

LOW-CODE/NO-CODE DEVELOPMENT

INDUSTRY

FRONTEND DEVELOPMENT

CLOUD DEVELOPMENT

MOBILE APP DEVELOPMENT

LOW CODE/ NO CODE DEVELOPMENT

EMERGING TECHNOLOGIES

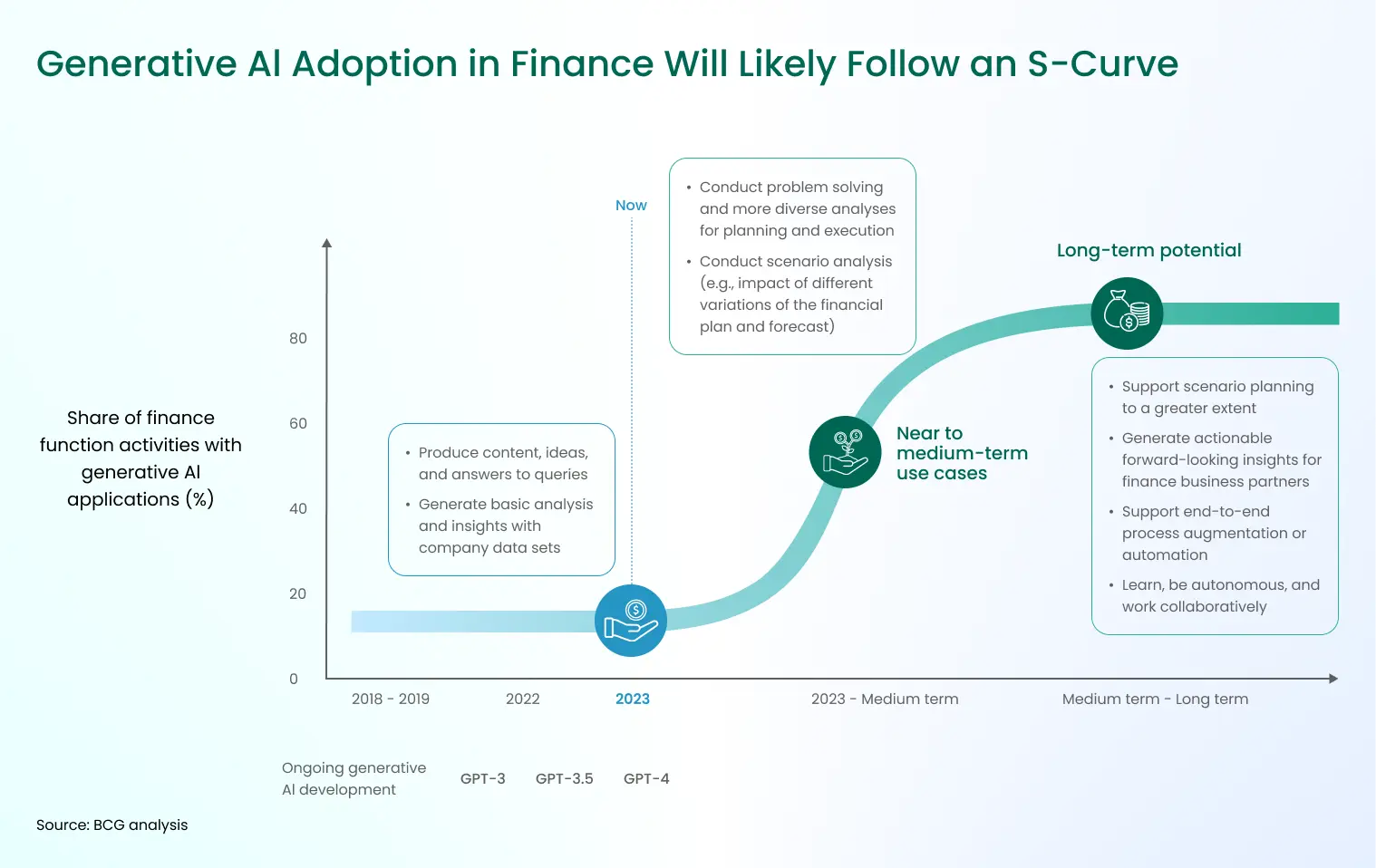

Generative AI in fintech is changing how financial institutions operate, analyze data, and serve customers. Since this technology entered the mainstream, banks, insurers, and fintech startups have been testing new ways to use it across their operations. Its ability to process complex financial data and produce actionable insights has made it one of the most promising tools in the industry.

While often described as next-generation technology, generative AI is already reshaping core areas such as fraud detection, customer experience, and risk analysis. McKinsey estimates it could add nearly $300 billion to the global economy every year, and around 70% of financial institutions with centralized AI systems are planning to use it to transform their business models.

From automating document generation to improving trading decisions, generative AI in fintech is no longer experimental—it’s becoming a practical advantage. In this article, we’ll look at how financial firms are adopting it, what’s driving the shift, and where it’s delivering the most value across financial services.

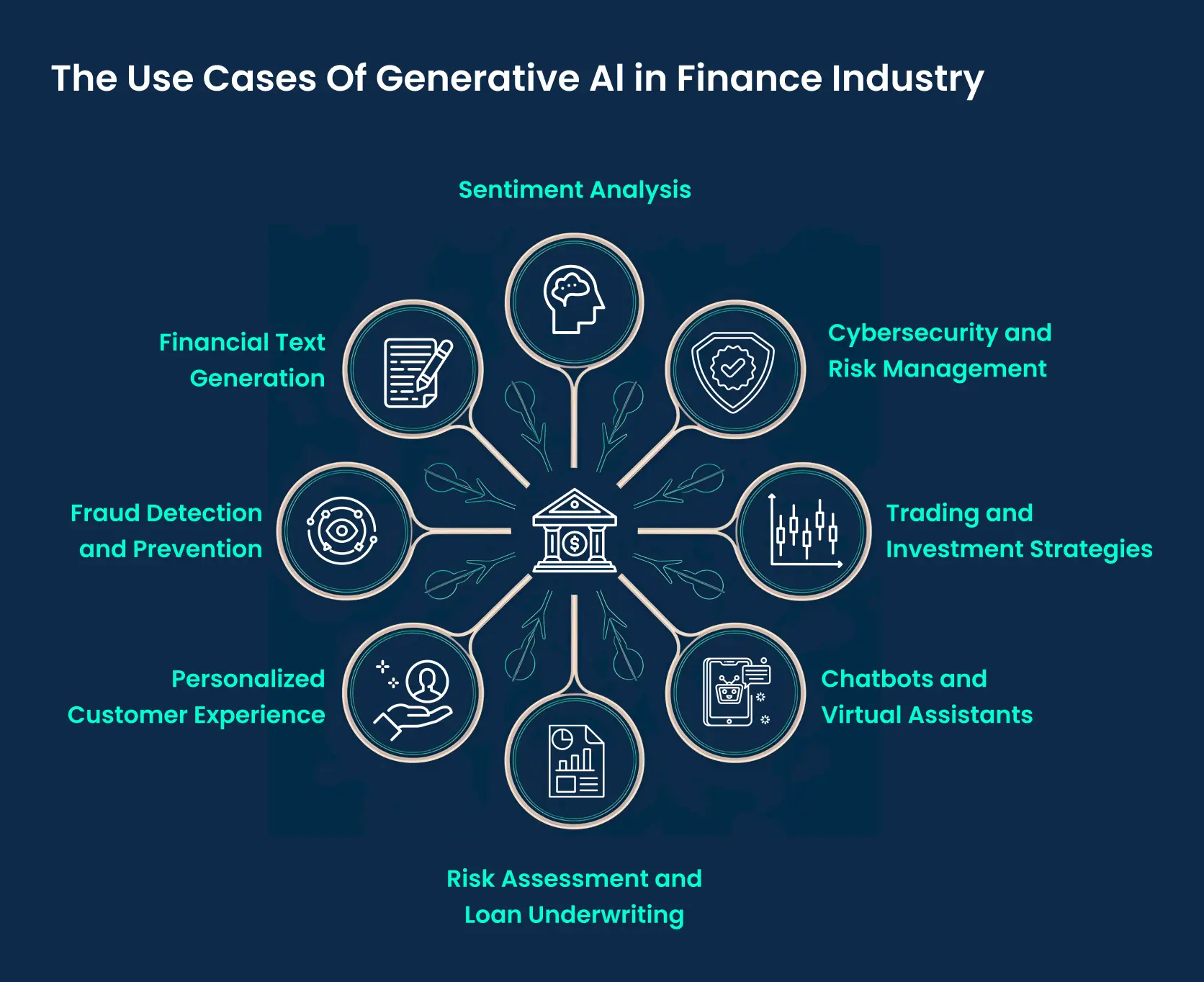

Generative AI in fintech is being used in many important areas of banking and financial services. Companies are applying it to handle large amounts of data, improve customer support, and make faster decisions. Some of the key uses include fraud detection, personalized customer advice, risk assessment, credit scoring, and even helping with trading strategies.

Banks and fintech companies are also using AI-powered chatbots and virtual assistants to answer common questions. These tools can handle routine requests, giving employees more time to focus on complex tasks. Wells Fargo, for example, uses AI to give customers tailored guidance, while RBC Capital Markets applies it to market analysis and trading decisions.

Even though AI models are not perfect, the better they are trained, the more useful they become. They can process data quickly, spot patterns, and support decision-making. In customer service, generative AI helps understand customer needs and improves responses, making interactions smoother and faster.

The growing adoption is driven by the need to work faster, reduce costs, and provide better customer experiences. With more data available and improvements in AI models, financial institutions are finding practical ways to integrate generative AI in fintech into their daily operations.

Several factors are pushing financial companies to use generative AI in fintech. One is the need to work more efficiently. Automating routine tasks like data entry, report generation, or basic customer queries lets employees focus on more important work.

Another reason is cost. By using AI to handle repetitive or time-consuming tasks, banks and fintech firms can save money while improving accuracy. At the same time, customers expect more personalized experiences. AI tools can analyze individual preferences and behavior, helping companies provide advice, offers, or alerts that fit each person.

Finally, improvements in AI technology and access to more data make it easier for organizations to adopt these tools. Machine learning models can now process huge amounts of information faster and more accurately than ever before.

Together, these factors are encouraging more financial institutions to explore how generative AI can improve efficiency, reduce costs, and create better experiences for their customers.

One of the biggest benefits is automation. AI can handle routine tasks like sending reports, analyzing market trends, or preparing notifications for customers. This saves time and allows employees to focus on more important decisions.

The speed of AI is another advantage. It can process information from hundreds or thousands of records in the time it would take a person to handle just a few. While AI isn’t perfect and still needs guidance, it can produce useful drafts, suggestions, and insights that help teams make better decisions.

The use of AI is also spreading quickly. More professionals are relying on AI tools, and new models can now handle multiple types of data, including text, images, and audio.

This makes AI more flexible for tasks like customer support, market research, and investment analysis. Companies are finding that the better they train their AI systems, the more value they get. Generative AI is being applied to real business problems, helping firms save money, improve accuracy, and serve customers better.

Here are some of the main ways it’s being used:

AI can analyze customer data to provide advice that fits each person’s financial goals. This helps banks and fintech firms give better, tailored suggestions for investments, loans, and savings.

Smart chatbots and virtual assistants can answer basic questions quickly and clearly. By handling routine queries, AI lets human staff focus on more complex issues, improving overall service quality.

AI can create customized investment strategies by analyzing market trends and client preferences. This helps improve portfolio performance and ensures strategies align with individual goals and risk levels.

Financial companies deal with lots of emails, documents, and reports. AI can organize this information into structured formats, making it easier to generate insights for decision-making and strategic planning.

AI can draft reports, regulatory documents, and other paperwork automatically. This speeds up workflows, reduces errors, and frees staff to work on higher-value tasks.

AI tools can support customer service by quickly finding answers and helping agents resolve issues. This improves response times and strengthens trust with clients.

AI can monitor transactions in real-time to spot unusual activity and potential fraud. It also helps assess credit risk more accurately by analyzing a wide range of data points.

Investment analysts can use AI to summarize earnings calls, filings, and news, helping them make better decisions faster.

AI can track regulatory changes and help ensure systems and processes remain compliant, reducing the chance of errors or penalties.

AI analyzes customer behavior to provide insights on spending patterns, financial health, and preferences. Companies can then use this data to create better products and services.

Financial companies rely on various AI platforms to implement generative AI in fintech:

AWS: Offers SageMaker, Rekognition, and Comprehend for model building, fraud detection, and analysis.

Microsoft Azure: Provides Cognitive Services and Azure Machine Learning for AI deployment, chatbots, and automation.

Google Cloud: Includes Vertex AI, Dialogflow, and Document AI for workflow management and document processing.

IBM Cloud: IBM Watson supports predictive analytics, regulatory compliance, and personalized services.

Salesforce Einstein: AI-powered CRM helps with lead scoring, customer segmentation, and personalized marketing.

H2O.ai: Open-source platform for scalable machine learning, predictive modeling, and fraud detection.

DataRobot: Automates AI development tasks like data prep, model selection, and tuning for financial applications.

Financial institutions are actively using generative AI to improve operations, make decisions, and give customers better experiences. From detecting fraud and assessing credit risk to analyzing customer behavior and supporting investment strategies, AI is helping teams work faster and more accurately.

Companies are also finding that AI can take over repetitive tasks. At the same time, insights from AI help fintech development companies tailor services to individual customer needs, which builds trust and loyalty.

For organizations looking to implement AI solutions, choosing the right platform and training models carefully is essential. Tools from AWS, Microsoft, Google, IBM, and others make it easier to integrate AI into everyday processes, giving companies a practical advantage in a competitive market.

Overall, generative AI in fintech is transforming how financial services operate. It combines speed, accuracy, and scalability to help businesses save time, reduce errors, and serve their customers in ways that were not possible before.

Generative AI enhances risk assessment by analyzing vast datasets in real-time, identifying patterns, and predicting potential risks more accurately. These insights enable financial institutions to make informed decisions swiftly, mitigating risks proactively.

Generative AI enhances fraud detection by continuously learning from transactional data to detect anomalies and suspicious patterns in real-time. This proactive approach helps financial institutions prevent fraudulent activities swiftly, safeguarding both customer assets and institutional reputation.

Generative AI enables personalized financial advice by analyzing individual spending patterns, investment behaviors, and life-stage indicators. This customization helps financial advisors offer tailored recommendations that meet specific client needs, enhancing satisfaction and financial outcomes.

Generative AI can enhance customer service by providing personalized interactions and timely responses through chatbots and virtual assistants. By understanding customer queries and preferences, AI can offer efficient solutions, improving overall satisfaction and operational efficiency.

Generative AI optimizes investment portfolio management by analyzing market trends, historical data, and risk profiles. It suggests diversified investment strategies tailored to individual goals and market conditions, helping investors make informed decisions and achieve better financial outcomes